The Safest Way to Invest in Cryptocurrency

Investing in cryptocurrency has become a popular avenue for those looking to diversify their portfolios and capitalize on the growth of digital currencies. However, with great opportunity comes great risk. In this comprehensive guide, we will explore the safest way to invest in cryptocurrency, providing you with the tools, strategies, and knowledge needed to navigate this exciting market safely.

Understanding Cryptocurrency

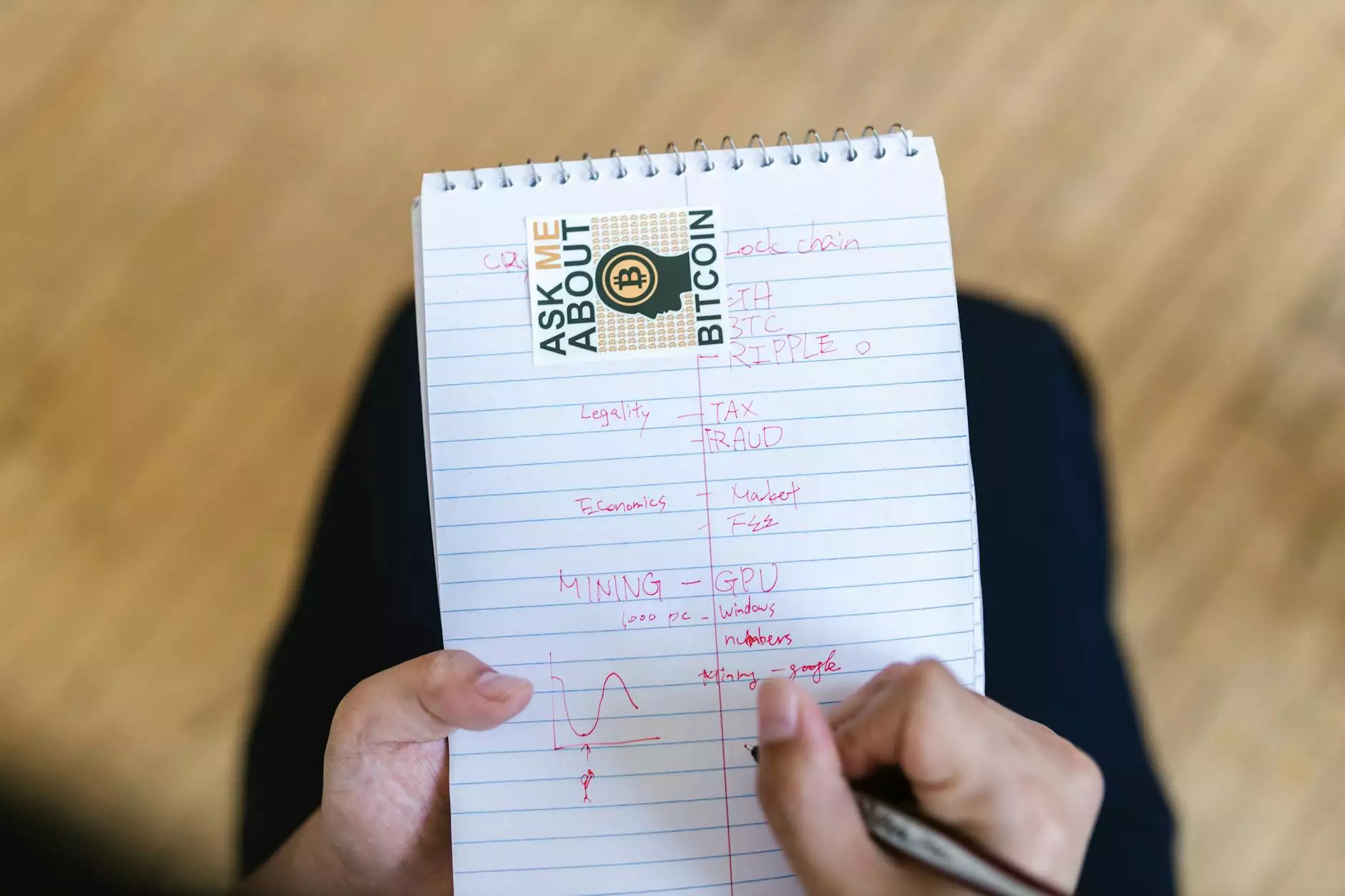

Before diving into investment strategies, it’s crucial to understand what cryptocurrency is. Cryptocurrency is a form of digital or virtual currency that uses cryptography for security, making it nearly impossible to counterfeit. Blockchain technology underpins most cryptocurrencies, providing a secure, decentralized ledger of transactions.

Types of Cryptocurrencies

There are thousands of cryptocurrencies available today, but some of the most well-known include:

- Bitcoin (BTC) - The first and most recognized cryptocurrency.

- Ethereum (ETH) - Known for its smart contract capabilities.

- Ripple (XRP) - Aimed at facilitating international payments.

- Litecoin (LTC) - Often considered the silver to Bitcoin's gold.

- Cardano (ADA) - Recognized for its scientific approach to blockchain development.

The Risks of Investing in Cryptocurrency

While the potential for high returns exists, it is essential to remain cognizant of the risks associated with cryptocurrency investments:

- Market Volatility: Cryptocurrency prices can fluctuate dramatically.

- Lack of Regulation: Many governments have not yet established clear rules for the market.

- Security Issues: Exchanges can be vulnerable to hacking.

- Scams and Fraud: The crypto space has seen numerous scams, making due diligence crucial.

Strategies for Safe Investment in Cryptocurrency

To invest safely in cryptocurrency, you need to employ strategic approaches. Below are detailed methods that represent the safest way to invest in cryptocurrency.

1. Do Your Research

Understanding the fundamentals of cryptocurrencies is vital. Research each currency thoroughly before investing. Here are a few questions to consider:

- What is the problem this cryptocurrency aims to solve?

- How does the technology work?

- Who is behind the project?

- What is its market position?

Utilizing resources like whitepapers, community forums, and reputable news outlets will help you make informed choices.

2. Start with a Small Investment

To minimize risk, begin with a small investment. This approach allows you to learn the mechanics of investing in cryptocurrency without risking a large amount of capital. Invest only what you can afford to lose, especially as you familiarize yourself with market behavior.

3. Use Secure Wallets

Choosing the right wallet is crucial to safeguarding your investments. There are several types of wallets:

- Hardware Wallets: Physical devices that store your cryptocurrency offline, offering enhanced security.

- Software Wallets: Applications that store your cryptocurrency online, generally more accessible but less secure.

- Paper Wallets: A method of storing cryptocurrency on paper, which can be safe if stored in a secure location.

Regardless of the type, ensure that your wallet is secured with strong passwords and two-factor authentication.

4. Diversification

Just like investing in traditional assets, diversification is vital when investing in cryptocurrencies. Instead of putting all your money into one currency, spread it across various cryptocurrencies to mitigate risks. This approach not only buffers against potential losses but also capitalizes on growth in different sectors of the crypto market.

5. Stay Updated with Market Trends

The cryptocurrency market is fast-paced and constantly evolving. Stay informed with the latest news, trends, and market analytics. Follow reputable sources, join crypto forums and social media groups, and perhaps even subscribe to newsletters from trusted organizations. Knowledge can be your best ally.

6. Consider Using Dollar-Cost Averaging

Dollar-cost averaging is an investment strategy where you invest a fixed amount of money into an asset at regular intervals, regardless of price fluctuations. This method not only helps in acquiring cryptocurrencies more steadily but also reduces the impact of volatility, enhancing your potential for long-term growth.

7. Understanding Tax Implications

Investing in cryptocurrency can have tax implications. Many countries treat cryptocurrencies as assets subject to capital gains tax. It’s crucial to understand your local tax regulations and maintain accurate records of your transactions to ensure compliance and avoid penalties. Consulting with a financial advisor may also be beneficial.

8. Avoid High-Leverage Trading

Leverage might seem enticing, as it allows you to control larger positions than your initial capital would normally permit. However, it also amplifies your risks. For those new to cryptocurrency, it’s advisable to stay away from leveraging until you have a more profound understanding of the market dynamics.

Finding Reputable Exchanges

Choosing a trustworthy exchange is critical for safe investing. Here are some factors to consider when selecting an exchange:

- Security Features: Look for exchanges with strong security protocols, including SSL encryption, cold storage, and withdrawal protection.

- User Reviews: Investigate the reputation of the exchange by reading user reviews and analyzing their track record.

- Liquidity: Ensure the exchange has enough liquidity to accommodate your trades without causing significant price impact.

- Customer Support: Good exchanges provide responsive customer support to help resolve issues quickly.

Long-Term vs. Short-Term Investing

Understanding your investment goals is essential to crafting your strategy. Here, we can differentiate between long-term and short-term investing:

Long-Term Investing

If you believe in the viability of cryptocurrencies and are looking to capitalize on their growth over several years, a long-term investment strategy may be right for you. This approach requires patience, as you will hold your assets regardless of market volatility.

Short-Term Investing

For those looking for quick profits, short-term trading can be appealing. However, it requires a comprehensive understanding of market trends, technical analysis, and more active management of your portfolio. This approach can yield significant returns, but the risks are equally high.

Conclusion: Your Journey to Safely Invest in Cryptocurrency

The safest way to invest in cryptocurrency involves comprehensive research, strategic planning, and an awareness of market dynamics. While the potential for rewards exists, aligning your investments with a well-thought-out strategy can help mitigate risks and position you for success. Remember to invest only what you can afford to lose and stay informed about the ever-evolving landscape of cryptocurrency. The world of digital currencies is exciting and full of possibilities, but like any investment, it requires diligence and caution.

By following these guidelines, you can confidently embark on your journey into cryptocurrency investment, making educated decisions as you navigate the thrilling world of digital assets.